SBA loans are ideal when you want to expand your small business. Although, they do have downsides you need to be aware of.

Particularly when you place your personal assets at risk to cover the loan if your business defaults on loan repayments.

SBA loans are typically personally guaranteed to mitigate the potential risk of lending funds to a small business. However, that may need more business collateral. In addition, other business shareholders might also be required to sign limited or unlimited personal guarantee loan agreements.

Even though applying for an SBA business loan may seem straightforward - apart from all the paperwork. That is, unfortunately, not the case. Most SBA loans require you to provide a personal guarantee that the loaned amount will be paid in full, which can be risky. Especially if you don’t consider the following pertinent factors.

So, read on if you want to make a sound business decision!

Why SBA Loans Are Personal Guaranteed

Most SBA loans require you to provide a personal guarantee that the loaned amount will be paid in full, which can be risky. Especially if you don’t consider the following pertinent factors.

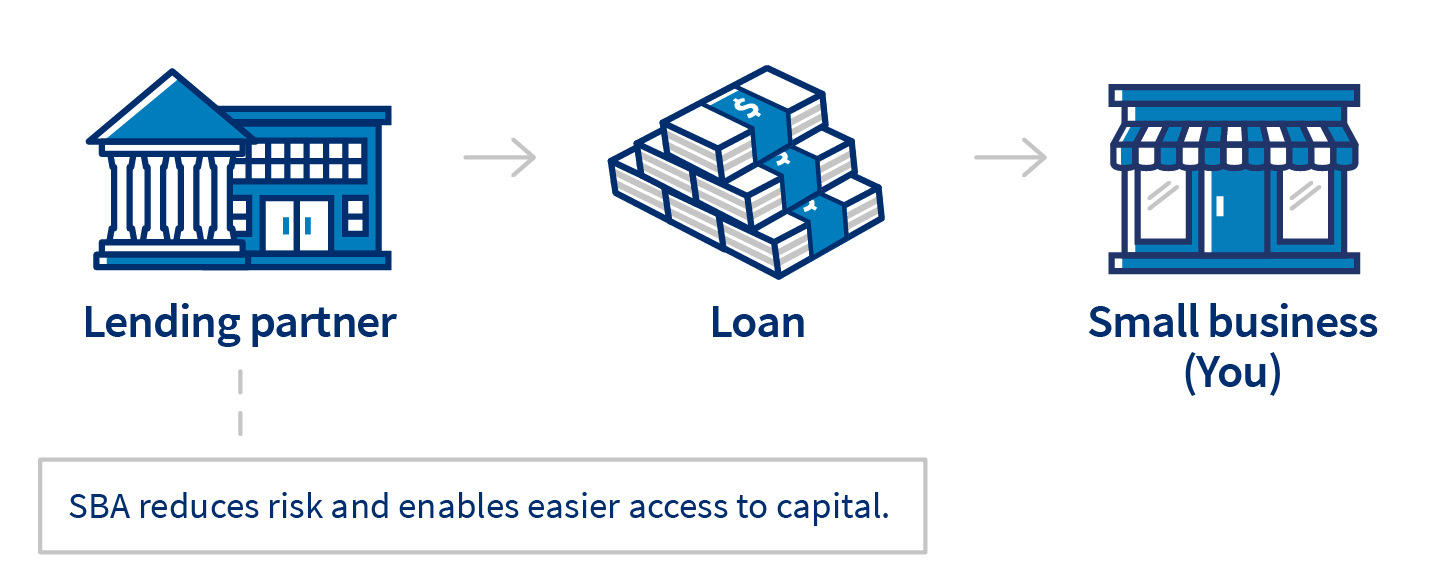

Like most lenders, Small Business Administration (SBA) requires a personal guarantee as an additional security measure to diminish the risk of a loan not being paid by a business. Thus, if your business cannot service the loan and make payments to reduce the loan, you might be held personally responsible for servicing the debt.

(Source: sba.gov)

However, SBA may also require more personal guarantees from your other stakeholders who have shares in your business if you apply for a massive loan. Even if you have enough business collateral to cover the loan amount.

The Difference between Limited and Unlimited Personal Guarantees

Like they say: knowledge is power! Thus, it’s essential to understand what limited and unlimited personal guarantees entail before you sign on the dotted line.

So, here's a quick rundown on unlimited versus limited personal guarantees:

Who is Liable for SBA Personal Guarantees?

While there are instances where SBA require limited personal guarantees, they typically need unlimited personal guarantee loan agreements from any stakeholder who has a 20% business share.

Although, the SBA may also insist that anyone with a 15% share in your business enter an unlimited or limited personal guarantee agreement. SBA may also require unlimited personal guarantees from:

However, if no one holds at least 20% of the business shares, one or two business owners must enter into a complete personal guaranteed agreement to safeguard the loan repayment.

When are SBA Loan Personal Guarantees not Required?

Even though personal guarantees are typically required for most Small Business Administration loans like 504/CDC, microloans, or SBA 7(a) loan agreements, there are some exceptions.

Disaster assistance loans don’t require personal guarantees if your business is in an area that has officially been declared by the US government as a disaster area.

(Source: sba.gov)

And you also qualify for an SBA disaster loan if your home has been damaged by a natural disaster like a wildfire, hurricane, or flooding. Including damages incurred due to civil unrest.

SBA disaster assistance loans apply to:

While disaster loans that don’t require personal guarantees are typically capped at $25,000. Business owners may apply for COVID-19 Economic Injury Disaster Loans for up to $200,000.

Personal Guarantee: Key Considerations

Even though most SBA loans require personal guarantees, it’s essential to "tread with caution" and consider the following aspects:

So, you need to review your personal finances and ensure you have enough savings or assets to cover the loan amount in an unforeseen, worst-case scenario.

Most importantly, consider whether you have the financial means to replace any personal assets that may be at risk due to a personal guarantee loan agreement.

Final Thoughts

SBA loans typically require personal guarantees, which means that should your business default on loan repayments, all guarantors are personally liable for that debt. So, it's vital to do your due diligence and do a thorough risk assessment, as you may place your financial wellness at risk.