Rewarding high-performing employees with a great cliff vesting benefits package is a prudent business decision as a motivated workforce is essential for financial sustainability. Although, devising a cliff vesting benefits package with so many options can be challenging.

Small businesses benefit from cliff vesting as it attracts and retains top talent. Most cliff vesting benefits plans are three years long, so employees must remain in a business for that period. And companies have adequate time to monitor their employee's performance before they are vested.

Even though establishing a cliff vesting plan for your key employees may sound simple on paper, that is not always the case in practice. Offering cliff vesting benefits to your loyal and hard-working employees benefits small businesses. So, let's look at what it entails and how to best structure your cliff vesting benefits plan to boost your employee's productivity and create a thriving business.

So, if you want to devise a cliff vesting offering aligned with your business needs and retain your top talent – read on!

Cliff Vesting Explained

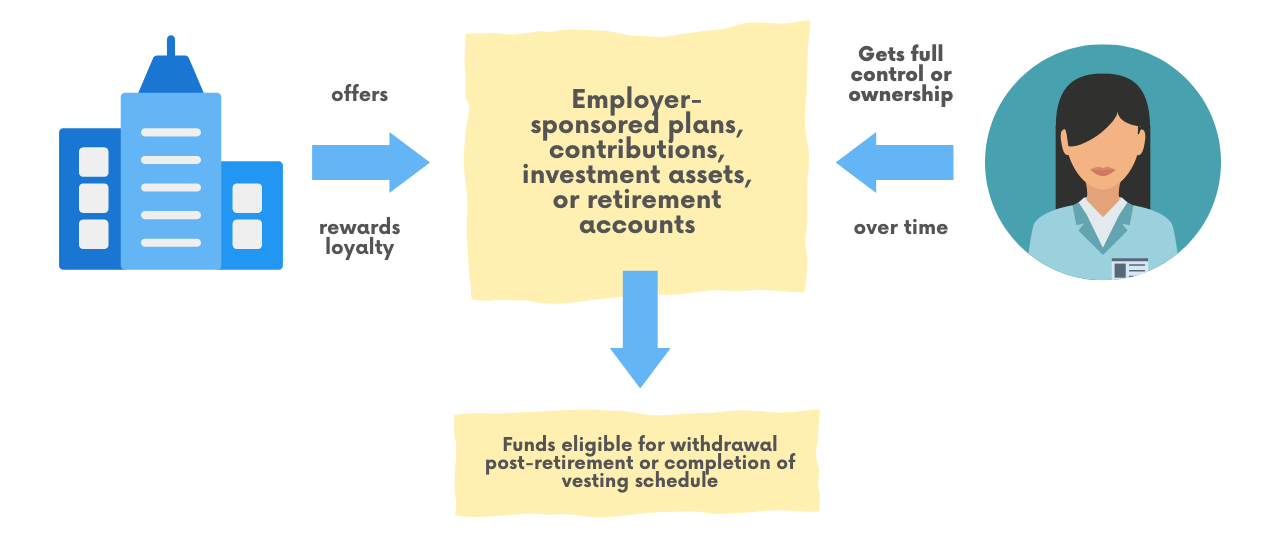

Before we delve into why cliff vesting may be beneficial for your small business, here’s a brief overview of what it entails:

Cliff vesting implies that employees are entitled to all their retirement, pension plan benefits, or “stock options” at a predetermined date. It is typically a 3-year vesting process instead of a gradual vested process over a far more extended period.

The Benefits of Cliff Vesting for Small Businesses

Cliff vesting may benefit your small business by allowing you to evaluate your employee's overall performance before they are rewarded with benefits.

It is especially advantageous if your business is a startup or is not well established, as cliff vesting is an attractive prospect for highly talented individuals. Mainly because cliff vesting timelines are relatively short. And, with a cliff vesting plan, your employees are not entitled to receive your matching contributions if they resign before the predetermined vesting date.

Although, it’s essential to point out that cliff vesting may also be a "double-edged sword" or risky for employees as they will lose their vesting benefit if they are fired or if a business fails before their vesting date.

So, while cliff vesting benefits small business owners, it can create uncertainty for employees, mainly because employees are often fired before their vesting date, even though their level of performance is outstanding. Although, some employees abuse startup cliff vesting plans as they tend to resign as soon as they are eligible for their vesting benefits. Therefore, it’s essential to understand that cliff vesting has pros and cons.

Innovative Stock Cliff Vesting Options For Small Businesses

There is a wide array of stock vesting plans ranging between milestone and time-based schedules to hybrid versions that are time and milestone-based.

With time-based equity vesting plans, employees are rewarded with stocks or shares in a business after a set period. Therefore, they need to remain at the company until their vesting date. While the milestone vesting plan rewards employees with shares or stock options once a project has been completed or when they meet a predetermined business objective.

As mentioned, the hybrid version combines a milestone with a fixed period. Thus, employees are only rewarded with shares once they have worked for the company for a certain period and reached a specific milestone.

Cliff Vesting Defined Contribution and Benefit Plans

Another critical consideration is whether you will be offering your employees a defined benefit plan or contribution plan, as these retirement plans determine the number of benefits they will receive once they become vested.

Cliff Vesting Works like this in Practice

Under IRS retirement plan statutes, defined contribution retirement plans like 401 (k), including 403 (b) plans, are tied to three-year cliff vesting periods.

While pension plans and defined benefit plan cliff vesting periods may not exceed five years in total. So, those are essential factors to consider when reviewing cliff vesting alternatives. And while the retirement plan you offer to your employees may specify what is considered a cliff vesting year of service, according to the IRS, a year equates to 1,000 working hours over 12 months.

Although it might be helpful to look at how cliff vesting works in practice, so here's an example of how your employees may benefit once they are fully vested:

Suppose you opt for a 3-year cliff vesting retirement plan for an employee. In that case, you match the employee's contribution with 5%, and the employee invests $9,000 annually in their retirement plan. The employee will be entitled to all the following benefits once they have completed three years of service:

Although, it is essential to point out that there are alternatives like immediate and graded retirement plan vesting options to consider. Immediate vesting plans entitle employees to access their employer-matching retirement contributions when the funds are paid to their retirement plan accounts.

With graded vesting plans, employees become vested over a more extended, gradual period in which they receive a more significant percentage yearly. Although, graded vesting plans are not typically offered by small businesses.

Final Thoughts

Small businesses can benefit from cliff vesting plans as they help assess employees' performance before they are eligible for their benefits. And it attracts top talent, as the prospect of being rewarded with shares, and retirement plan benefits, in a short period is a powerful drawcard.