Considering a "PEO" for the Human Resources and payroll needs of your business?

We'll break down PEO's, and how they could benefit your business in this pose.

What is PEO?

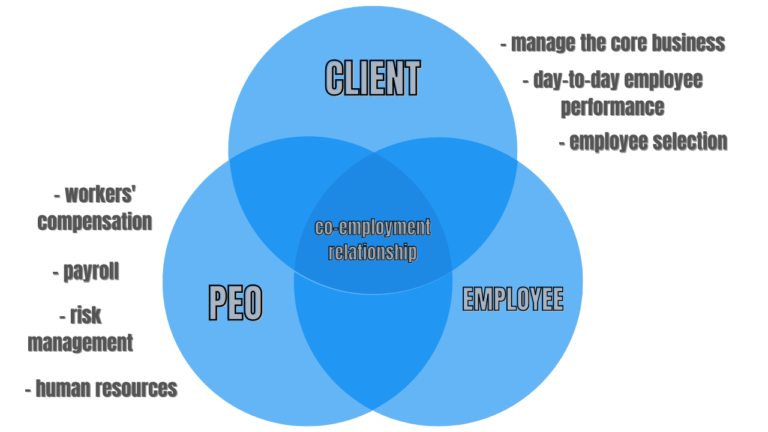

You might be wondering, “What does PEO stands for?” Or you’re simply asking “What is PEO?” Well, it simply means Professional Employer Organization. It is a firm that goes into a relationship with an employer and outsourced its workers to the employer, and then manages and shares most of the employer's employee-related responsibilities. This joint-employment relationship allows employers to commit their operations to third parties. These human-resources operations include compensation and payroll administration, employee benefits, employment taxes, and worker's compensation.

PEOs often act as professional employers for the employees of their clients. Employee liability moves to the PEO after the client company declares its salary under the PEO's federal employer identification number (FEIN). Employers benefit from economies of scale by having a wider range of benefits to choose from, often at reduced costs. A few or all HR functions can be outsourced, depending on the PEO and the contract. Companies who do not want to co-employ but want some of the outsourcing benefits can use an administrative services outsourcing (ASO) arrangement.

A PEO can provide considerable benefits, particularly for small businesses that may lack the depth of HR expertise or system capabilities for services like payroll and HRIS, as well as the time and resources to focus on many transactional HR functions.

Stay glued to your screen because we would be reviewing what PEO stands for and also everything you need to know about PEO.

How Does PEO Works?

Now that we’ve done justice to the questions, “What is PEO?” and “what does PEO stand for?” We can now move into its mode of operation. The PEO and the client company will enter into a contract known as a client service agreement in a PEO arrangement (CSA). According to the CSA:

- For certain administrative services, the PEO serves as the administrative employer, while the client serves as the worksite employer.

- The client company is in charge of hiring and managing personnel, as well as all other non-employee-related areas of the business operations (such as sales, marketing, and customer service).

- As long as the CSA is active, the PEO is responsible for processing employee salaries, benefits, and withholdings, as well as remitting and reporting taxes to any applicable state and federal authorities.

- As indicated in the CSA, certain obligations, like developing an employee handbook, may be divided between the client company and the PEO.

Types of PEO

Although there is just one form of PEO, known as co-employment, employers are still unsure about the business model. This misunderstanding stems from the improper use of the term "employee leasing" to characterize PEOs and their services over the years. PEOs are still referred to as a sort of leasing in several state legislatures' statutes.

Benefits of a PEO

While it may be tough to entrust important areas of your business to an outside entity, business owners all across the country are discovering the advantages of working with a PEO. Working with a PEO can free up a significant amount of time and energy for time- and energy-strapped employers who would otherwise be spending it on payroll and other necessary but time-consuming duties. Businesses who partner with a PEO can expect a slew of advantages, including:

- Saves Time: Clients report that having the PEO handle the time commitment involved with standard HR activities frees them up to focus on other key company operations.

- Saves Cost: A PEO's purchasing power in terms of workers' compensation and health insurance is typically greater than that of a small firm.

- Peace of Mind: At any moment during the employee life cycle, business owners may be assured that they are not alone.

- Employee Benefits are Better: Companies who want to offer competitive benefits packages can take advantage of Fortune 500-level perks and skilled administrative support.

- Tracking and administrative operations have been improved: In most cases, the PEO will undertake an in-depth HR review to reduce risk and maximize chances for growth and development.

Do PEOs offer Benefits to their Employees?

When a company uses a PEO, its employees might obtain access to perks that are generally only available to large companies. Health insurance, disability insurance, employee aid and discount programs, 401(k) plans, and other benefits are examples of this. In addition, the PEO gives online access to employees' pay stubs, payroll reports, and W-2 forms without having the client company buy and set up the infrastructure to provide these services to their employees.

Companies that use a PEO typically have reduced group insurance expenditures since PEOs can negotiate better prices with insurance companies due to their larger employee base. Because their employees are classified under the PEO's federal ID number for payroll purposes, PEOs can usually negotiate a reduced state unemployment insurance (SUI) premium.

The Cost of a PEO

The cost of a PEO is determined by many criteria, including the size of the company, the services that will be outsourced, and the number and types of employees on the payroll. Typically, PEOs charge a set cost per employee or a percentage of overall payroll.

Businesses should expect to pay between $40 and $160 per month if the PEO charges a flat price monthly (per employee). Flat-fee rates are more predictable and might assist businesses in better budgeting their HR costs. The invoicing savings from a flat fee might be particularly beneficial for firms depending on the number and type of employees. Businesses should anticipate paying between 3-12 percent of the total monthly payroll for all employees if the PEO charges a percentage of the total payroll. This will result in a monthly charge that fluctuates, especially if the company employs several part-time hourly workers.

Calculate yearly expenses using both pricing methods to determine the estimated PEO cost. When it comes to cost, many PEOs are willing to be flexible when establishing a new contract, so knowing which choice makes the most financial sense for your company might be beneficial.

Selecting a PEO

Working with a PEO may not be ideal for every firm, despite the numerous financial, time, and administrative benefits. Even after concluding that a PEO can help your firm, it's critical to find one that offers the correct mix of add-on services, benefits, and service agreement flexibility. Because a PEO will have a big impact on your employees' experience, use these best practices to assist you to find the ideal PEO to meet your most pressing demands.

Examine Auditing, Performance, and Accreditation

PEOs operate in a highly regulated industry, and they will be in charge of sensitive employee information, sophisticated documentation and tax forms, as well as a significant quantity of cash flow. When it comes to picking a PEO, the first thing you should look for is one been run properly. Consider the following options:

- Is the National Association of Professional Employer Organizations (NAPEO) a member?

- Is an outside source checking the PEO's financial accounts and operations? Whenever possible, have an objective auditor analyze and approve the PEO's financials.

Compliance Expertise

Failure to comply with all applicable state and federal tax and employment rules can cause your company to lose time and money. That's why dealing with a PEO that specializes in compliance is crucial. From monitoring changes to meeting crucial compliance deadlines, a PEO should have the knowledge and ability to assist you with your compliance problems, as well as the ability to support you as you establish systems and processes that make compliance easier.

Range of Benefits

Another crucial factor to examine is the PEO's benefits. Companies collaborate with PEOs for a variety of reasons, one of which is to gain access to a bigger pool of benefits options. Take the time to study the PEO's programs, how they compare to your current offerings, and how much they will cost. Consider whether the PEO provides any value-added services, such as pet insurance or employee support programs, that might aid you in attracting and retaining high-quality employees.

Client and Professional References

Dealing with a PEO provider with a proven track record of working with firms similar to yours is ideal. Your sector, company size, and specific goals and business issues are all things to think about. Look for case studies that show how they'll solve your problems, then go to customers, referrals, and business partners to obtain a second opinion on how well they're doing. You'll be able to better verify the information you've obtained on your own and have a better knowledge of what to expect before signing a PEO services agreement if you receive another viewpoint.

Service-level Agreements: How might they Benefit Your Team?

Because a service-level agreement (SLA) is the operating document that governs a company's relationship with a PEO, it's vital to comprehend its contents. An SLA reveals how much support, consulting, and guidance the PEO will provide your team in addition to the services provided. It will describe which responsibilities your PEO will take up for you and specify each party's responsibilities. Look for PEOs that offer a clear, simple SLA, and don't be hesitant to ask questions if something is unclear. It's a good sign of a successful working relationship if a PEO is prepared to help you comprehend all of the provisions of the SLA upfront.

Choosing the appropriate PEO may elevate your HR, payroll, and capital management operations, leading to happier employees, improved benefits, and considerable cost savings for your company. Taking the time now to learn more about some of today's top PEOs might assist you in determining what you need in a PEO. This investment can pay off handsomely for your small business in the long run, freeing you up to focus on future expansion.

What a PEO Does Not Do

Your Business is not controlled by PEO: You can rest certain that a PEO is your co-employer exclusively for the purposes specified in your contract (e.g., paying your employees and the other HR responsibilities specifically named in your CSA). When you work with a PEO, you'll have access to HR professionals that can help you with advice and guidance. They assist in the administration and risk management of your company's employees, but you retain control of the business and all operational choices.

- Internal HR Staff Won't be replaced by a PEO: PEOs work in sequence with your company's current HR department or personnel to provide supplemental expertise, such as assistance with workplace policies and culture shifts. A respectable PEO will hire seasoned, credentialed HR specialists with diverse industry expertise. As a PEO customer, you have access to their knowledge. This can be quite useful when dealing with difficult HR circumstances or workplace improvement projects, such as Increasing employee motivation, effectively dealing with conflict, and Creating pay plans that are aligned with the company's objectives.

- Reputable PEOs do not cause workplace disturbance: When you become a PEO customer, your current employees will see little to no disturbance. They'll notice the PEO's name on their paychecks, but they'll be most interested in how their benefits package has likely improved since you joined a PEO. Furthermore, some PEOs have online self-service alternatives that allow employees to manage their personal information, benefits, and pay stubs at any time.

Disadvantages of PEO

- Control over critical processes and people have been lost.

- The impact of an outside corporation on your culture.

- The internal HR department's value has decreased.

- Employee paperwork is not under control or secure.

- There has been a loss of institutional expertise.

- The vendor's system has security vulnerabilities.

- Employees are resisting.

Types of Businesses that Benefit from PEOs

Co-employment arrangements are most common in small and midsized firms, although larger organizations can also benefit. PEOs are a good fit for nearly every industry, including, but not limited to:

- Property Management and Real Estate

- Technology and Computer Services

- Brokers and Dealers in Securities

- Services in Engineering

- Services in the Medical Field

- Legal Assistance

- Services in Management Consulting

- Services for businesses

- Accounting, Auditing, and Bookkeeping are all aspects of Accounting

- Manufacturing

- Other trades include plumbing, HVAC, electrical, and others

- Insurance

- Wholesales/Nonprofits

Conclusion

To sum it all up, joining a PEO is a wonderful way to get rid of a lot of the tasks you have as an employer that isn't related to why you started your company in the first place. Having another company act as an administrative co-employer relieves you of your HR responsibilities for good, knowing that they will treat your employees with the same care, expertise, and dependability that you do.

With a PEO, benefits, payroll, HR compliance, and many other services are consolidated into a single, easy-to-manage vendor relationship. You save time, learn new methods to be more productive, and obtain strategic assistance with aspects of your organization that would otherwise be too expensive or time-consuming to see.

With the contents of this article, you should have full knowledge about PEO and also be able to answer the questions “What is PEO? And "what does PEO stands for?". Thank you for reading!