Suppose you, as an investor, are interested in acquiring a small business. You will undoubtedly face certain challenges and risks; that’s a given. But some businesses present more risk than is necessary to take.

The correlation between revenue and customer contribution to revenue and profit is high on the list of possible risks. It would be best if you delved deeper to make an informed decision.

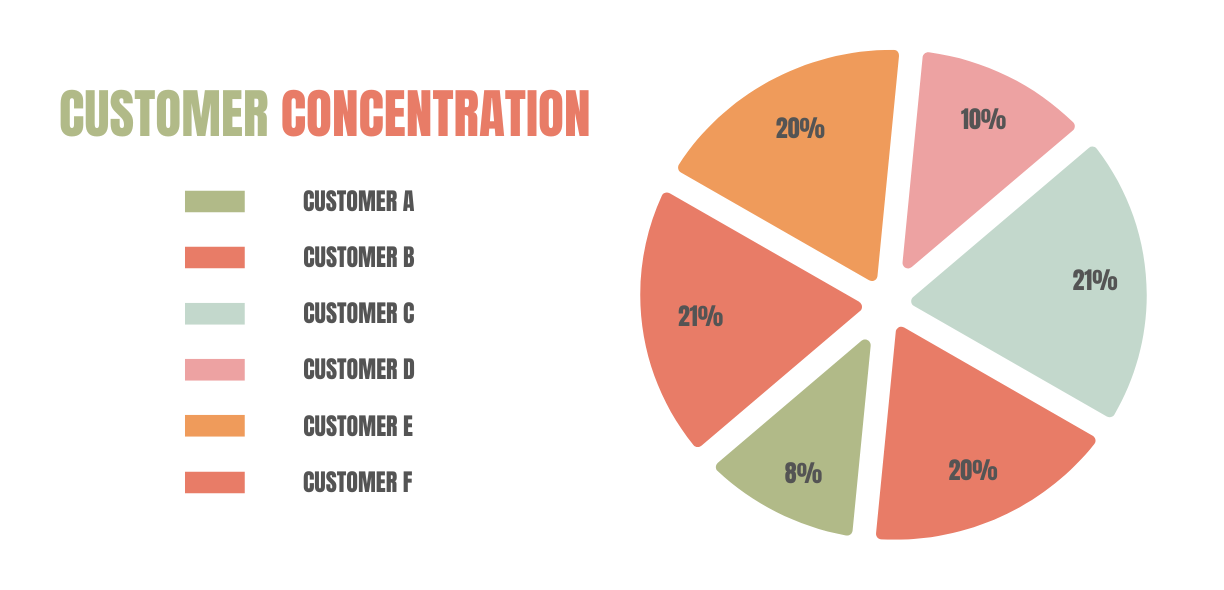

It’s risky buying a small business with customer concentration. If 10% of the business’ income comes from 1 client or 25% from 2 or 3 clients, losing these clients could be a financial setback. Do a due diligence study and examine the real risk of large clients before deciding to buy the business.

Customers are the lifeblood of any business. To this point, the health of a small business is largely dependent on customer relationships and the portion of revenue each customer generates. Suppose a high percentage of income depends on one or two customers. The impact of losing one of these could spell disaster. Knowing the risks and how to counter them are of paramount importance.

Let’s get started.

Think twice before Investing in a Small Business

Buying a new business is always a risk. Aside from analyzing the revenue, profit, and expenses, there are numerous other factors to consider. Customer concentration is one of these and must be evaluated along with the business’ financial statements. Failure to take a deeper look into the distribution of income and business mechanics could lead to a bad business decision.

For example, suppose you specialize in manufacturing and have found a small business that caters to a niche market. While this often presents a great source of revenue as there’s no competition in the marketplace, you may have a very small or single customer base.

Many businesses start with one big anchor client, which makes sense. This allows the business to get off the ground with good income generation. If the business doesn’t move past this starting point, consider it an alarm bell.

So, the niche business's income looks good on paper, but the prospects may be dim if you lose an anchor client. This could happen for various reasons, but the effect on your manufacturing facility will be crippling. Your expenses, such as rent and staff, will remain the same.

Economies of scale won’t be possible. You may have a few smaller clients you must still service with no consistent source of income. Your business could change from running in the black to running in the red.

The business may survive if you invest further capital or secure more clients. If you can’t, you will lose your initial investment and be liable for other costs incurred. Along with this comes the challenge of paying creditors, insurance, wages, and utilities which inevitably will send your revenue into a downward spiral.

Customer Concentration can Present a Challenge

Customer concentration is described as a large portion of revenue resting in the hands of a small number of customers. Customer concentration can present several threats to a business, especially a small business.

Larger customers are generally highly profitable, and expenses are easy to control. Economies of scale and pooled resources add to bigger clients’ increased bottom-line value.

Most likely, the revenue from larger clients covers the lion’s share of costs and expenses. Losing this revenue will negatively impact the business’ ability to continue delivering the same quality of service or product to the remaining clients in its portfolio.

There is a Disadvantage to Having Large Customers

Customer concentration can present several threats to a business, especially a small business. Suppose a large portion of the business’ success depends on one or two clients. In that case, chances are good that you will encounter several issues along the way:

Start by Doing a Thorough Due Diligence Study

It is prudent to do a thorough due diligence study before acquiring a business, particularly before making an offer on a small business. Take your time doing this and fast forward to potential scenarios should the business lose a primary client.

A due diligence study looks at various indicators to determine the business’ health and whether investing in it is feasible. Studies are classified as either hard or soft studies. Hard studies examine facts from a business perspective; these are:

Also, pay attention to the detail in which financial reports are presented and how frequently they are updated.

Suppose these figures stack up, and there are no irregularities. In that case, the buyer may assume that the business is financially sound and worth investing in.

Analyze the Hard Due Diligence to Determine Customer Concentration

Even though the business is financially sound, customer concentration must be factored in, especially with the acquisition of a small business.

Use the following calculation to determine the value that a particular customer provides to the company’s profitability:

For example, the value of business revenue is $1,000,000

The client contributes $100,000

$100,000 divided by $1,000,000 = 0.1

0.1 multiplied by 10 = 10%

Therefore, the client generates 10% of the business value.

Suppose 10% or more of the business’ revenue comes from a client. Then that client poses a risk to the business.

By adding the next 2 or 3 biggest revenue generators and applying the same calculation, you'll see how much business revenue is attributed to top clients. If the percentage is more than 25%, customer concentration is a cause for concern.

Use Hard and Soft Due Diligence Studies to Measure Feasibility

After determining whether there is customer concentration and, if so, with which clients, you should map this against the soft due diligence issues.

A sound business consists of more than just numbers. Often overlooked, soft due diligence focuses on areas of management, staff morale, working conditions, customer relationships, and other unquantifiable aspects of the business.

The question is, how strong is the business’ foundation, and could it weather any storms should any soft issues be compromised.

Ask Questions after Analyzing the Business

Look at the soft business issues and see how these relate to a particular client relationship. Find out what the circumstances are around the client in question. Ask relevant questions to get the information you need.

Question | Information Required |

|---|---|

Who has the primary relationship with the client? | If it is the current business owner, will the client leave when the owner leaves? |

How often does the client change suppliers? | Can you bank on the client's business, and for how long? |

Is the client satisfied with the goods and services the business provides? | Is there a risk of the client leaving? What could be done to fix any existing problems? Will fixing problems secure the customer? |

How long has the client been a customer? | Is the relationship stable, or are there teething problems that may jeopardize the relationship? |

Is there a valid contract in place with the customer? | Is there any chance of an ineffective contract? What is the impact of the terms of the agreement? |

Is the client’s business sustainable? | Are there any factors influencing the market in which the client trades? |

Find out what is important to the customer and what their expectations are? | Can you meet the client’s expectations with the resources available to you? |

Is the customer creditworthy? | What is the likelihood of late or non-payment? |

Aside from determining the existing relationship with a high-value customer, there are other important factors to consider:

Mitigate the Risks Associated with Customer Concentration

According to Elon Musk, “It’s okay to have all your eggs in one basket as long as you control what happens to that basket.”

Suppose you check all the boxes and the effects of customer concentration do not pose an immediate threat. In that case, it is still wise to put a strategy in place to future-proof the business:

Final Thoughts

High customer concentration is risky if you are buying a small business. Suppose one customer makes up 10% or more, or a few customers total 25% of the revenue.

In that case, you risk financial ruin if these customers no longer support you. Do thorough due diligence before acquiring the business and pay special attention to the customer relationship and the customer’s future prospects.