As an entrepreneur or an employer, you need to familiarize yourself with many business terms and concepts. That is why it is crucial to know what does TTM mean, as it will help you with your business performance and finances. So, if you are wondering the meaning of TTM, you are in the right place.

Here is everything you need to know about TTM.

What Does TTM Mean?

Trailing twelve months (TTM) refers to the past twelve consecutive months of an organization's performance data used to report financial figures. Remember that the twelve months here do not have to be twelve months of the fiscal year. TTM is primarily used when the information of the previous fiscal year is out of date and doesn't reflect the organization's accurate data or current standing.

You can use TTM for your business in a myriad of ways, which is why you can calculate it with various data. When using TTM, it is crucial to highlight the goal of the calculation and the information gone into reaching a particular figure. You can gather the information from:

- Cash flow statements

- Income statements

- Balance sheets

- Other financial sources

After that, you can transfer the numbers in a ratio or report for easy calculations.

Top Three Reasons Why A Business Might Use TTM

Many people wonder what does TTM mean and its importance for a business. Well, here are the top three reasons why an organization might use TTM:

1. Being Up-to-date with Company’s Financial Health

As an entrepreneur or employer, it is crucial to know the financial health of the organization. Of course, the data should be accurate, up-to-date, and reflect the company's current standing. That is why TTM is crucial.

You can use TTM to see how the last year of financial performance has affected the current year. You can also compare the data and have a realistic overview of the company’s finances. It will aid you in better financial decision-making.

2. Looking at the Big Picture

Any company is just as good as the vision of the people investing in it. You can look at the TTM financials to help you plan long-term. When it comes to looking over at the TTM, don’t be stuck in the past and focus on the current fiscal year too.

After all, just looking at past TTM figures will keep you efficient and holistic financial planning. In addition, you can use the TTM data to gain a better understanding of what the data is revealing about the business's potential future. So, looking at the big picture will help with financial planning.

3. Understanding what is Normal for your Business

The smaller your current financial data set is, the more chances you won't be able to see what is expected and abnormal for your business. That is because all companies fluctuate when it comes to:

- Price-to-earnings ratio

- Working capital over a year

- General revenue growth

You can misinterpret such data if you are looking at old, out-of-date, or just a few quarters of financial information. That is why it is crucial to calculate your TTM so you can look at KPIs (key performance indicators). These will help you understand if you are in a predictable seasonality cycle or you are trending towards a downturn or abnormality.

Example of TTM in the Business World

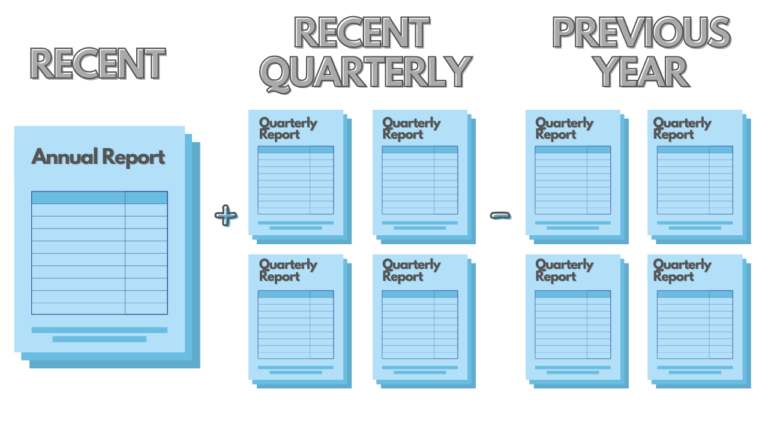

TTM equals the last complete fiscal year plus the most recent year to date minus last year's year-to-date period. It is essential not to use just the latest quarter, but also the year to date. That is because it will make a significant difference in the second and third quarters each year.

Let’s take an example in the business world to understand how TTM works:

Let's assume that an organization has reported its Q2 2020 earnings. You want to calculate the earnings for the last twelve months. In such a case, you will take the year to date for the most recent period, which will be Q1 and 2.

After that, you will take the last complete fiscal year and subtract last year's year-to-date period. Many people make the mistake of taking the latest quarter instead of the year-to-date period. However, doing that is only okay if you are in Q1.

If you make this mistake in Q2, you will not get the last four consecutive quarters for your TTM. So, it is important to understand this example in the business world and get your TTM accordingly.

What can Businesses Measure with TTM

It is crucial to understand what your business can measure with TTM. The TTM data can apply to a wide range of reporting and financial situations. That is why what you are measuring will depend on your goals.

Of course, the top reference points are your KPIs. Your TTM data will help you understand how well you are achieving targets without lags. It will give you a more accurate reflection of your performance indicators.

Besides that, you can use TTM data to help you understand revenue margins and growth. Knowing this will help you curb some of the uncertainty that you will see across various financial periods and seasons. Many businesses also use TTM to analyze their price-to-earnings ratio and sales figures, which is something important for shareholders to know.

Final Words

That was a complete guide to what does TTM mean and the business examples. It represents the financial performance of the business in the past twelve years and will help you achieve a better sense of your finances. You need to know these figures to create future goals.

So, if you are trying to calculate your TTM and figure out the financial position of your business, follow our guidelines. It will help you understand TTM in a much better light, especially if you are new to running or owning a business. In addition, such financial figures are important to understand the overall business success and financial position in the long run.