Suppose you are starting a business with a few shareholders on board. In that case, you might have reached the predicament of choosing between an S corp or an LLC. With these two choices having similarities, there is one question that remains. Is it possible for an S corp to own an LLC?

An S corp can own an LLC. A Limited Liability Company is an entity that provides ownership interest through shares. These shares can be purchased by other business entities or individuals. An S corp is an independent legal entity, enabling it to invest and buy the shares distributed by an LLC.

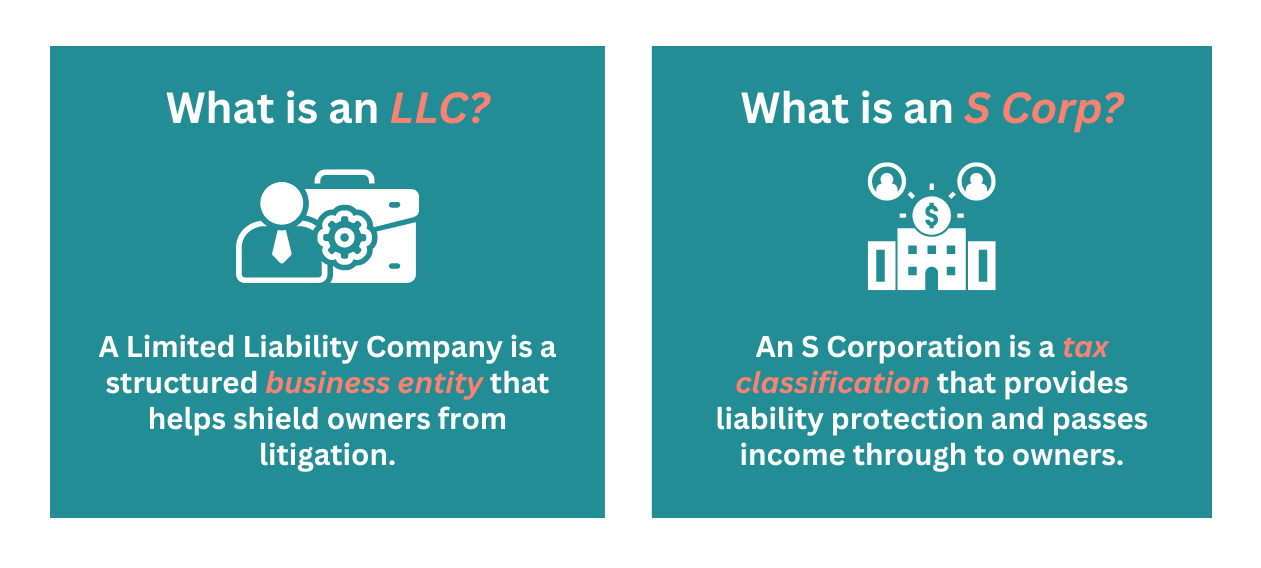

When starting a business on a smaller scale, an S corp or an LLC are the most popular options. Both business structures provide pros and cons while allowing easy collaboration.

However, how does owning an LLC benefit an S corp?

Conversely, could an LLC own an S corp?

How can an S Corp Own an LLC?

An S corp can own an LLC because of their business structure differences. An LLC (Limited Liability Company) is standardly owned by various members who can be individuals or businesses. Therefore, an S corp, being a business entity, can become a member of an LLC.

Moreover, a corporation is greatly advantageous for newly rising businesses as the business structure enables these companies to sell stocks or ownership percentages internationally. With this, you gain three primary benefits from an S corporation owning an LLC.

You Gain more Flexibility of Profit Distribution and Ownership

Gaining flexibility while distributing profit and ownership is immensely valuable when an individual or other business entity has contributed 'sweat equity' in addition to capital investments.

This means that the members handling daily procedures with the company can outweigh the value of their initial contribution compared to other members. Where an S corp is normally required to divide shares matching to a shareholders’ capital contribution, this is not the case with an LLC.

Your Assets Receive Additional Protection

An S corporation may create an LLC subsidiary to protect the company's assets. By transferring the asset ownership to the LLC, the assets transferred are entirely protected from the parent company's liabilities. This additional coverage is beneficial should the initial company acquire any legal issues with creditors.

(Related article: What is Asset-Based Lending for Small Businesses?)

Begin the Diversification Process of Your Business

The process of diversification entails a business wishing to extend either its product line or its brand into other markets.

The flexibility of ownership with an S corp enables you to either introduce a new LLC or purchase an existing LLC. The S corp can then utilize these LLCs to release or launch existing products into new markets.

The Taxation Differences Based on Various Ownership

Different scenarios exist regarding the ownership relationship between an S corp and an LLC. There are three primary S corp ownership types (single-member LLC, partnership, corporation), and each type renders a different taxation process.

Can an LLC Own an S Corp?

Considering an S corp and an LLC have close similarities regarding their business structure, you would believe that the opposite acquiring of ownership is possible. Unfortunately, other business entities, such as an LLC, cannot become shareholders of an S corp. According to Subchapter S, the ownership of an S corp is restricted against individuals, specific trusts, or certain estates.

However, there is one exception to this policy. In certain cases, an LLC comprises a single member that has not initially signed up to be taxed as a corporation. This single-member LLC can receive permission to require the ownership of an S corp under strict requirements.

How the Business Structure affects Ownership

An S corp and an LLC have similar concepts, yet certain aspects separate them. For example, they are both labeled as pass-through entities by the IRS (Internal Revenue Service). This relationship allows the companies to protect their shareholders and members from recorded liabilities.

But how do these two business structures differ?

The Business Structure of an S Corp

An S corp distributes its shares according to each shareholder’s beginning investment value. Thereon, your shareholders can buy or sell their company stock at will while still benefiting from avoidable double taxation.

An S corp will remain in operation until its shareholders conclude to liquidate the company. While in operation, the company must reach an annual requirement of presenting reports and documents with the relevant state.

The Business Structure of an LLC

An LLC is much easier to form than an S corp because operation requirements and administrative duties are less restrictive. This acquired freedom also enables the company to develop unique plans for dividing company profits. In addition, these strategies are not required to correspond with capital contributions or ownership percentages.

Regarding an LLC's memberships, there are no rules restricting the number of members of the citizenship status of the company. The taxation within an LLC falls under self-employment tax, such as a sole proprietorship or a partnership. The only scenario where this taxation process would change would be when the file is indicated to be taxed as a corporation.

Final Thoughts

Forming an S corp or an LLC is a great starting point for newly developed businesses. However, an S corp has more flexibility of ownership over its counterpart, including various types of ownership. Even though the opposite is technically possible, it is a rare occurrence.

In addition, an S corp owning an LLC provides many benefits, such as diversification and asset protection.