Back in August of 2009, the show Shark Tank debuted and suddenly everyone became an armchair venture capitalist. The idea of investing some money in a brilliant idea, with some determined founders, earning huge returns captivated the attention of anyone with half a business hubris.

And now 8 years since the first investments were made, we can easily see the positive results and success each investor is having.

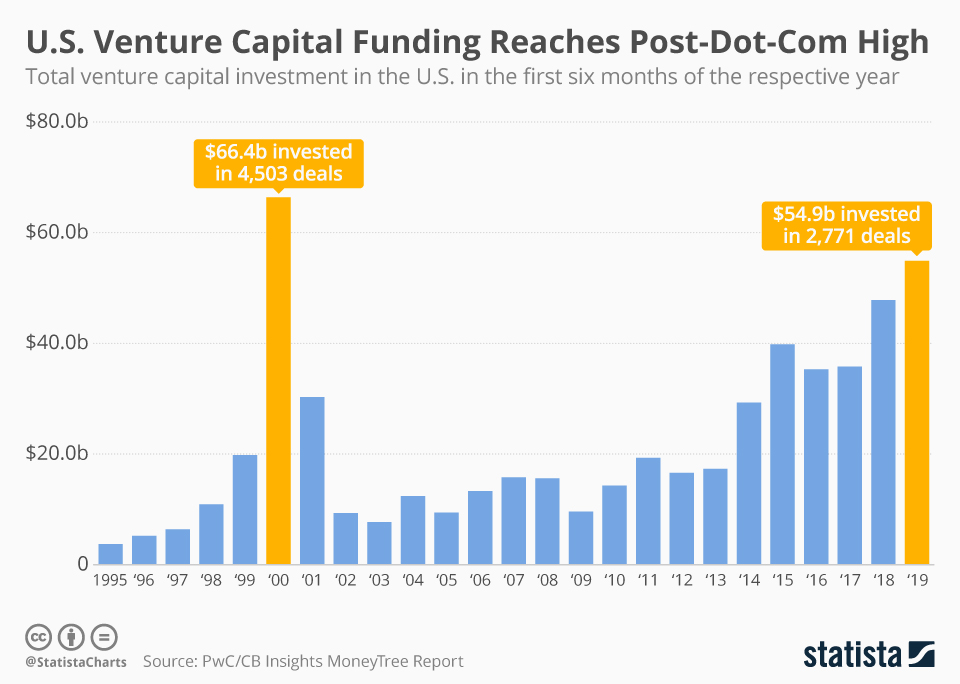

But Silicon valley caught on too and everyone with a checkbook is a venture capitalist and the cash is flowing freely. Goldman sachs reports a record 121 billion of ‘Dry powder’ (aka cash ready to be invested) in venture capital funds. Meanwhile the total annual value of all venture capital deals closed in the US since 2008 has more than doubled from just under $30 billion to just over $61 billion.

You will find more infographics at Statista

You will find more infographics at Statista

Perpetuating it all is solid growth in the US stock market as a whole which has risen by 202.97% (S & P 500 total return 8/9/2009 – 10/21/2017) since the launch of Sharktank, and kept optimism high in the VC world

And now venture capital comes to the masses with companies like Seedinvest, and Republic. No need to even step foot in the valley. No Mark Cuban size wallet need to get started. All you got to do is open an account on either of those platforms, spend a few minutes inputting your information and you’re free to start picking great idea’s and making winning investments for as little as $1,000 (I think it might even be less for some opportunities). Seedinvest will even make it easy to diversify your bets and passively invest you into 25 start-ups for as little as $200 each.

I have to admit, the concept wowed me. I’m a business guy. I’m an investor. I’ve always been an armchair VC and now’s my time to get in on the action. Here’s one company caught my attention: Keenhome, a company that makes air vents that you to control temperature by room. It solves a problem I’m personally familiar with. Sometimes one room in my house is hotter than another. Fortunately I live alone, so climate control is at my sole discretion, but in a household with multiple people the thermostat can cause wars. Keenhome’s product solves it. It’s also in the smart home category which is trending right now, with an expected revenue growth rate of 21.8%. I own a home service company which has done rather well, and a friend of mine owns a wildly successful HVAC business which is very closely related to this product niche. They’ve also done $2,600,000+ in sales and have a slew other pitch facts indicating success. Certainly it must be a good investment.

But I’m not convinced any of these investments on crowd capital platforms are going to work quite as well for you and me as they have for the sharks. Here’s why:

-

-

Why do they need crowdfunding?

As I mention above cash is flowing right into the venture capital world. Seemingly anyone with an idea, a little business acumen, and a little charisma can easily get a deal. There are large scale venture capitalists following all the funding syndicates… reserved for accredited investors. They aren’t idiots, and they aren’t short on cash.

As I mention above cash is flowing right into the venture capital world. Seemingly anyone with an idea, a little business acumen, and a little charisma can easily get a deal. There are large scale venture capitalists following all the funding syndicates… reserved for accredited investors. They aren’t idiots, and they aren’t short on cash.If a business is truly a good ‘opportunity’, there’s no reason why they need to go to the little fish in crowdfunding. Established venture capitalists bring more to the table than just cash (more on that below), and there’s less headache dealing with a few large professional investors than dealing with the masses.

-

The sharks invest more than financial capital?

Mark Cuban, Kevin O’leary, Daymond John, Laurie Greiner, Rob Herjavec, Barbara Corcoran, all the other sharks, and all the other sharks, and all the professional venture capitals swinging 8 figure bankrolls bring more to the table than just their wallets. They’re bringing copious amounts of personal capital, and sweat equity. They’ve got the experience, resources, and connections to make businesses happen.

Sure you might have a ton of business experience, but does your few thousand dollar investment get you a seat on the board of advisors — nope. Don’t even bother making a squeak. If you’re Cuban or anyone else with an amount of capital and credibility your voice gets heard.

Sure you might have a ton of business experience, but does your few thousand dollar investment get you a seat on the board of advisors — nope. Don’t even bother making a squeak. If you’re Cuban or anyone else with an amount of capital and credibility your voice gets heard.What if the company has a great marketing campaign but just can’t pull it off in operations? What if the company needs an effective website live in 12 hours? Every venture capitalist has a team behind them they can call to make things happen. No searching , no hoping, just action. In many cases the founders, become little more than faces of the company while the venture capitalists use their resources behind the scenes to make things happen.

Connections…. Lets just ask how many business journalists follow established venture capitalists? One twitter post is all it takes to get the company featured in a forbes article about how “XYZ Company is going to reshape an industry?” Can you get that poole?

While the Sharks and other Venture capitalists can make things happen, you’ve just got to sit with your fingers crossed. -

What happens when the market tanks?

Seriously. We’ve been in a long bull run now. Rags to riches stories are abound. If there’s a bear market blue chip equities will take a hit, but venture capital will go to 0. Venture capital funding will slow and that bottomless pool of money many startups are relying on to grow will dry up.

While not optimal that works out for the venture capitalists who are able to plunk in more of their personal equity, sweat equity, or personal capital to keep these ventures afloat.

-

A Better Choice

If you have the capital, look for a venture capital fund that you can invest in alongside, well known venture capitalists. These funds exist, but they do require minimum investments of generally, at least $100,000 and are illiquid. That’s a far step above the $1,000 minimum investments in a single company on SeedInvest. BUT they do provide a better shot at likely returns as you get access to the premium deals that would never make considering taking on million peon investors from crowdfunding. You also ride on the coattails of investors who have the personal capital to make businesses happen. On that note, make sure the investor has a significant amount of their own capital in the fund. I should probably write a whole nother post on that relative to venture capital, but for now just checkout my post on manager investment in mutual funds.

Now if you don’t have $100,000 to piss away, and you’re practical enough to not get into gambling with your money, a small cap index fund would be your next logical choice. Small cap stocks have been shown to have a premium over market beta (market cap weighting significantly tilted to large caps). From 1926 – 2012 small caps returned a 1.8% annual premium over large caps (that 1.8% over a couple decades is huge). You can get into small cap exposure for nearly nothing by opening an account with vanguard and buying their Small Cap Index Fund ETF (VB) or the mutual fund that tracks it. Just set it to reinvest dividends and dollar cost average into investment.

Follow Up Post 10/25/2017: What if Mark Cuban was never a venture capitalist and just invested in index funds?

It Still Seems Fun

Yes it does. That investment in Keenhome seems like a good idea. I think it can beat the small cap index. I want a horse in the race. I want a company to cheer for. I want to be part of the cool kids. Maybe I will invest in it, for the same reasons I go to casinos (for the record I don’t go to casinos).